Europe’s defence landscape is undergoing rapid transformation, driven by heightened threat perceptions, NATO capability targets and long-term investment commitments. Between 2025 and 2035, NATO European members are forecast to spend over $2.2 trillion on equipment and R&D.

This page spotlights four major programmes, one from each domain (land, naval, air, and UAS), which are defining Europe’s defence posture and industrial priorities.

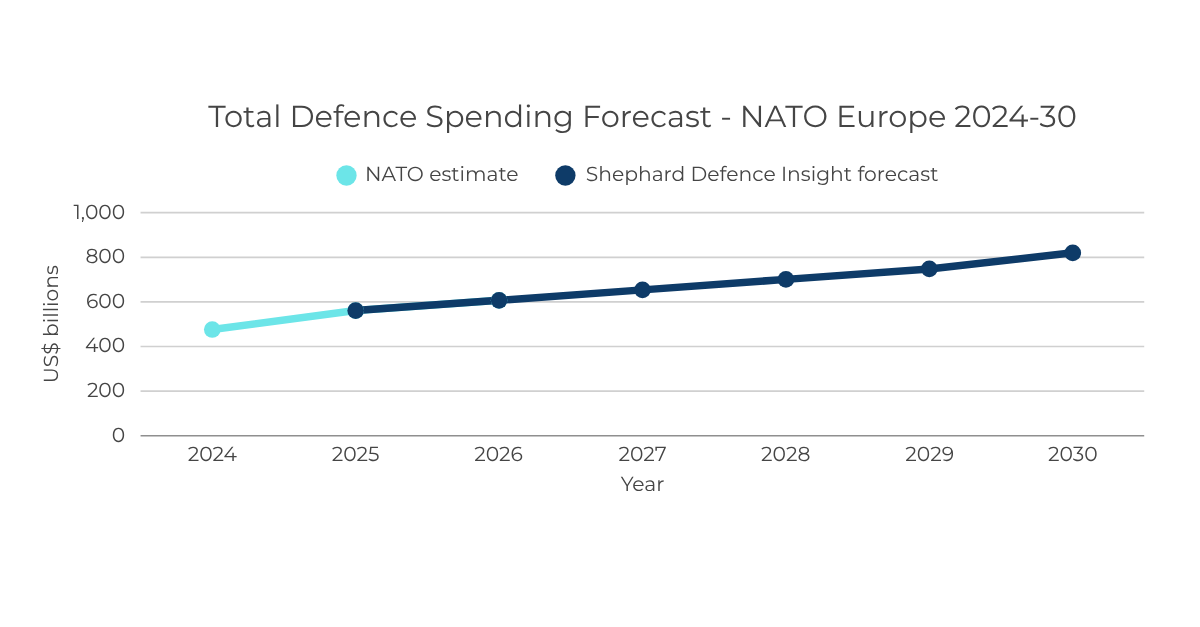

The Total Defence Spending Forecast – NATO Europe 2024–30 chart is drawn from verified programme and spending data within Shephard’s Defence Insight® platform. It illustrates a steady upward trajectory in equipment and R&D investment, with NATO Europe on course to reach annual spending of around $1 trillion by 2035.

The forecast reflects sustained adherence to NATO’s 2% GDP target, reinforced by elevated threat perceptions following the Russo-Ukrainian War, and highlights the concentration of high-value procurement activity in key nations such as the UK, France and Germany. By leveraging Defence Insight®’s transparent methodologies and forward-looking analysis, the projection provides industry stakeholders with a robust basis for strategic planning in the decade ahead.

Germany

Germany is embarking on a $12.4 billion modernisation programme to procure an estimated 650 Leopard 2A8 MBTs.

The move follows NATO’s June 2025 request for Germany to field seven new brigades on the alliance’s eastern flank. Each brigade will require at least 44 MBTs, alongside 88 infantry fighting vehicles. Backed by a constitutional exemption on defence spending and a planned rise to 3.5% of GDP by 2030, the Leopard 2A8 initiative marks a decisive step to bolster conventional land warfare capabilities.

ireland

In February 2025, Ireland announced its intent to establish a dedicated combat air capability for the first time.

The plan calls for the procurement of 12–14 fighter aircraft, with candidates including the F-16V Block 70/72, JAS 39E/F Gripen, and FA-50. Estimated at up to $2.5 billion, the programme reflects a significant policy shift and aims to address emerging aerial threats. If realised, it will represent the most substantial investment in Irish air defence to date, altering the nation’s strategic role within Europe’s collective security framework.

United Kingdom

The UK’s SSN(R) programme will replace the Astute-class submarines from the 2040s, with a projected total cost of $26 billion.

Developed jointly under the AUKUS agreement with the US and Australia, the SSN(R) design will integrate vertical launch systems and ensure interoperability with US naval assets. BAE Systems and Rolls-Royce are leading design and reactor supply work, with the first construction contract anticipated in the late 2020s for a planned fleet of seven nuclear-powered attack submarines.

United Kingdom

The UK’s Loyal Wingman project, part of the RAF’s Autonomous Collaborative Platforms strategy, aims to field 120 attritable UAVs by 2030.

Following the cancellation of Project Mosquito, the LANCA follow-on programme focuses on cost-effective, combat-capable UAVs that can operate alongside crewed aircraft in manned-unmanned teaming (MUM-T) roles. Industry contenders include Boeing’s MQ-28A Ghost Bat, Kratos’ XQ-58 Valkyrie, and several European designs, with procurement expected to begin in 2029.

Data shown is for example purposes only.

Regular intelligence briefings on defence markets worldwide. Covering key trends, regional outlooks, programme factsheets and domain-specific developments.

Analysis of emerging capabilities expected to influence force structures, procurement and operational priorities.

Learn more about market intelligence provided by Defence Insight® and how it can benefit your business.